It has been more than 6 months since the launch of Arbitrum. Although the project was initially upstaged by shitcoins and rug-pull projects, Arbitrum kept growing. According to L2beat (Figure 1), as of March 21, Arbitrum’s TVL reached approximately $3.2 billion, which is far ahead of all its rivals. The project accounts for 50% of the total Layer 2 TVL (about $6.35 billion), with a TVL that is 3.2 times higher than that of dYdX, the second-largest Layer 2 project by TVL.

These figures suggest that Arbitrum is stilled favored by investors, with a prominent status during the expansion of Ethereum. In addition, Offchain labs announced the launch of Anytrust Chains on March 2, opening more possibilities for the Layer 2 category. As such, we will discuss Arbitrum in two parts. Part 1 will present the overview of Arbitrum, examine its competitiveness from the perspective of users, and compare the project with its rivals. In Part 2, we will introduce the native ecosystem of Arbitrum and focus on its growth prospects.

Introduction to ArbitrumArbitrum is an Ethereum scaling solution created by Offchain labs, which raised $120 million in a Series B round back in 2019, with involvement from leading institutional investors such as Pantera Capital, Polychain Capital, Coinbase, etc.

Arbitrum features cheap, fast transactions and sends all transaction information back to the main Ethereum chain. Here is a simple comparison: Ethereum processes about 14 transactions per second, and the gas fee varies according to how congested the network is. Moreover, the gas fee soars to hundreds of dollars when Ethereum is highly congested. By contrast, Arbitrum comes with 40,000 TPS and charges about $0.6 in gas fee per transaction. Furthermore, Arbitrum is fully compatible with Ethereum Virtual Machine (EVM), which means that developers can directly integrate their Dapps with Arbitrum, cutting the time required for redevelopment.

It is easy to understand how Arbitrum is run. Simply put, Arbitrum packages multiple transactions or things together, settles them on a designated sidechain, and then submits the transaction data to the main Ethereum chain. The network employs a technology called Optimistic Rollup, which compresses the data of blockchain transactions and rolls them up into a single transaction. The advantage of this approach is that the blockchain only needs to process a single transaction without having to confirm the transactions contained in the Rollup, thereby saving both time and gas fees.

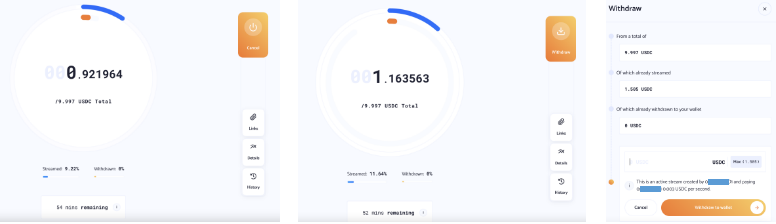

On Arbitrum, security is guaranteed by validators. By default, Optimistic Rollup assumes all transaction data to be correct. Despite this, if a validator suspects that fraud may exist, the relevant transaction can be challenged through the dispute resolution mechanism. As such, Optimistic Rollup has introduced the challenge period. If the validator has found a suspicious transaction, he/she may challenge the transaction, and the challenged transaction can be recovered during the challenge period. As a result, it only takes about 10 minutes to transfer funds from the Ethereum mainnet to Arbitrum, while sending funds from Arbitrum back to the Ethereum mainnet takes approximately a whole week.

The Competitiveness of Arbitrum

When it comes to the competitiveness of Arbitrum, analyses that focus on the technical differences among Layer 2 projects may seem unintelligible to the average user. As such, we decided to adopt the perspective of users and noticed that there are two things users really need: 1) satisfying user experiences, and 2) strong asset security. The paragraphs below will focus on these two factors.

In terms of user experiences, when making crypto transfers, users are more concerned with the speed of their transactions and how much gas fee they should pay. From this perspective, Arbitrum’s rivals are not limited to Layer 2 projects but also include high-performing Layer 1 main chains like Solana, AVAX, and BSC that also feature high TPS and low transaction fees. Moreover, assets on such Layer 1 projects can be quickly swapped across different chains and withdrawn as well.

Over the past year, as Layer 1 and Layer 2 projects flourished, assets on Ethereum spilled over to other blockchains. In terms of the market shares of Ethereum bridges, the lion’s share is now taken by AVAX, followed by Polygon and Ronin. In this regard, Arbitrum ranks 4th.

According to the above ranking, Arbitrum is not the best choice. One of the reasons is that the project is less superior in terms of the gas fee than Layer 1 projects like AVAX, Polygon, and Solana, which charge negligible gas fees. However, the Arbitrum team said that they will reduce the gas fee in the future by increasing the speed limit while expanding the network capacity.

Meanwhile, the fee will be lowered as Arbitrum’s transaction volume grows larger. Secondly, Arbitrum suffers from long cross-chain cycles. For users who demand high asset flexibility, a waiting period of one week is a big concern. However, many cross-chain bridges that support Arbitrum have solved this problem. For example, the Hop protocol uses intermediate assets and AMM mechanism from cross-chain swaps, which reduces the time needed to swap Arbitrum’s Layer 2 assets to other chains.

Despite such defects, Arbitrum still boasts many advantages. The biggest selling point of the network lies in its full compatibility with EVM. This means that developers can migrate their Ethereum-based applications onto Arbitrum quickly and cheaply, without having to modify the original codes. With Arbitrum, users can use native protocols on Ethereum with lower costs, which is great news for loyal Ethereum users troubled by the expensive gas fees.

At the moment, over 150 Ethereum-based projects, including the leading protocols or Dapps of various Ethereum infrastructures, are running on Arbitrum one. Additionally, on March 2, 2022, Offchain labs announced the launch of Anytrust Chains, which will be run together with Arbitrum one for further optimization targeting the fields of gaming and NFTs. When the Anytrust chain is live and running, Arbitrum will cover NFT/GameFi projects, in addition to DeFi protocols.

Regarding asset security, one should focus on two factors: 1) protocol security of the network, and 2) the risk of hacking when swapping assets across different chains. Protocol security of the network: Arbitrum, a sidechain of Ethereum, is as secure as Ethereum. As such, the project’s security is fully ensured.

Cross-chain risks: When used to swap Ethereum assets from/to other chains, the top high-performing Layer 1 projects have all suffered security breaches. For example, the Solana-based cross-chain bridge Wormhole was once hacked, and the cross-chain bridge of THORchain had been the victim of three consecutive attacks, resulting in a loss of more than $16 million. Assets are exposed to the risk of hacking when swapped from Ethereum to other Layer 1 blockchains or sidechains. When Ethereum assets are swapped to Arbitrum, on the other hand, the risk of hacking is significantly lowered thanks to the Rollup and the challenge period.

Here, we must shed light on other Layer 2 projects that also employ Optimistic Rollup. Right now, projects featuring Optimistic Rollup include Optimism, Metis Andromeda, and Boba Network. To be more specific, Metis and Boba are two branches of Optimistic with expanded scaling performance and lower gas fees.

The above table shows that fees charged by Arbitrum are still higher than several other projects that also use Optimistic Rollup. The greatest difference between Optimism and Arbitrum lies in compatibility, which explains the drastic gap between the two projects in terms of the market share and the number of ecosystem-based Dapps, even though they were launched during the same period. In addition, Boba and Metis achieved faster withdrawals — instead of having to wait a week or so, users can withdraw assets in minutes or hours. Compared with these projects, Arbitrum is superior in its well-established ecosystem, which helped the project secure a large market share.

The Arbitrum Ecosystem

As mentioned above, since Arbitrum is highly EVM-compatible, the big infrastructure projects on Ethereum were deployed on Arbitrum soon after it was launched. Through Arbitrum, users can try out Ethereum projects with low fees and at a high speed. For instance, DEXes like Uniswap, Sushiswap, and Balancer, stablecoin projects such as Curve Finance and Abracadabra Money, as well as cross-chain bridges including Ren, Multichain, and Synapse are all available on Arbitrum. That is an essential reason why Arbitrum has managed to grab market shares within such a short period. The project provides smoother and cheaper trading experiences for loyal Ethereum users.

In this section, we will not dive into the native protocols of Ethereum. Instead, we will focus on the outstanding Arbitrum-enabled protocols, which include the following:

Dopex

Dopex is a decentralized options platform that offers liquidity to option traders through option pools while maximizing gains for both buyers and sellers of options contracts through a rebate system, as well as arbitrage functions. The protocol was built by an anonymous team of 18 developers, with @tztokchad and @witherblock at its core. It has received investments from Tetranode and DeFiGod1, two DeFi KOLs.

At its core, Dopex provides Single Staking Option Vaults (SSOVs), which allow users to lock up tokens for a specified period of time and earn yields on their staked assets. Users will be able to deposit assets into a contract. The system then sells the deposits as call options to buyers at fixed strikes that they select for end-of-period expiries. To put it bluntly, users deposit assets to sell a call/put option. By the same token, there will also be buyers purchasing a call/put option for hedging.

Options on Dopex are similar to conventional options. For users who deposit a call option into a pool on Dopex, if the price of the underlying asset goes up, SSOV depositors may preserve the dollar value of the option, i.e, buyers exercise the option contract they purchase, while sellers sell tokens at the strike price. If the price of the underlying asset drops, buyers choose not to exercise the option contract they purchase, while sellers may still preserve the value of their tokens. In both scenarios, depositors receive returns from their options and DPX rewards according to their liquidity share and the at-the-money ratio of the strike price.

Dopex adopts a dual-token economy where DPX serves as the governance token and protocol fee token. This means that fees charged for purchasing calls in an option pool, swaps, fines, and strategy vaults are all paid in DPX. At the same time, 15% of all fees charged will be distributed proportionally to DPX holders after each epoch. On Dopex, rDPX acts as the rebate token. To eliminate the risk of losses arising from extreme swings, option holders receive rDPX as compensation in each epoch. Dopex users can use rDPX to mint synthetic assets or have the tokens deposited as collateral to expand their exposure.

Sperax

Sperax is a decentralized stablecoin protocol that taps into both staking and algorithms. Its stablecoin USDs is backed by external assets plus its governance token SPA. To be more specific, USDs is minted by burning SPA and adding collateral. Sperax keeps USDs stable through collaterals and algorithmic stability (arbitrage).

The project is also backed by a strong lineup of institutional investors and developers. Sperax has completed a $6 million fundraising at the valuation of $200 million. Institutional investors including Amber Group, Alameda Research, and Jump Capital, as well as the big-name DJ Steve Aoki, invested in the project by purchasing SPA tokens. The team behind Sperax includes Nicolas Andreoulis, the former core developer of Terra, and Marco Di Maggio, a Harvard professor.

What is unique about Sperax is its dynamic transition between algorithmic and collateralized stabilization. Sperax uses an on-chain mechanism to calculate the fraction of the money supply that is algorithmically determined versus the collateralized. If the token price is above the peg, the money supply will be determined by algorithmic stabilization; if the price is below the peg, the reliance on external collaterals goes up. The major difference between USDs and other decentralized stablecoins lies in its built-in automatic earning feature, which earns interest through the DeFi aggregator on Sperax.

GMX

On GMX, an Arbitrum-based decentralized perpetual exchange, users can trade cryptos like ETH, BTC, and LINK with up to 30X leverage. The most prominent advantages of GXM are low swap fees and zero-slippage transactions. At the moment, the project is deployed on Arbitrum and AVAX and recorded a $380-million AUM. GXM ranks third among all Arbitrum-based projects in terms of TVL and has evolved into a leading decentralized perpetual exchange on Arbitrum.

To ensure zero-slippage transactions, GMX does not employ pools composed of trading pairs. Instead, liquidity providers stake assets such as ETH and BTC in the GLP pool, and this multi-asset pool performs swaps and leverage trading. The capacity of the GLP pool is larger than that of trading pair pools. Moreover, trades are priced based on the values provided by Chainlink and other DEXes, which minimizes the impact of slippage.

The project also employs a dual-token economy. GMX serves as the platform’s governance token, which can be used for staking. In addition, GMX holders receive 30% of the platform fees. GLP is the certificate issued to liquidity providers when they deposit assets into the GLP pool, and the price of GLP is based on (the total worth of assets in the GLP pool)/(GLP supply). GLP holders earn 70% of platform fees and esGMX that can be fully converted to $GMX after one year. By capturing liquidity through token incentives within a short period, GMX has recorded an increasingly higher trading volume and protocol revenue.

Generally speaking, most Arbitrum-based projects focus on infrastructures such as crypto wallets and cross-chain bridges. On Arbitrum, the second-largest category is DeFi, especially derivatives. The strong performance of Arbitrum creates an enabling environment for derivatives projects, as well as a slim chance of survival for projects that have been criticized for their poor liquidity and expensive fees. Finally, only a few Arbitrum projects focus on NFT and GameFi — there are now only three NFT projects in the Arbitrum ecosystem, with small trading volumes.

For a sidechain, NFT and GameFi projects are more demanding in terms of performance. This is the case because some applications need to minimize their costs or withdraw NFTs within a shorter period. In addition, the high-load operation and trading demands of GameFi projects also require strong blockchain performance. As such, Arbitrum will launch Anytrust Chains to enable the growth of NFT/GameFi projects within its ecosystem.

Growth Prospects

In a market where Layer 1/Layer 2 projects pursue competitive differentiation, where is Arbitrum headed? When will the project record exponential growth?

Arbitrum has taken a different path. As an Ethereum sidechain, Arbitrum is built to solve the scalability issue of Ethereum, and the Arbitrum team has always been committed to this original goal while enhancing the network’s performance from a technical level.

As for the issuance of native tokens, when Arbitrum was just launched, the community believed that Arbitrum would follow the same path as other Layer 2 solutions — airdropping native tokens to early users. However, Off-chain labs confirmed that it does not plan to offer any such native tokens.

After this announcement, the growth rate of Arbitrum’s TVL significantly slowed down. Moreover, the project even lost about 50% of its TVL. In today’s context, the 50% loss might just be a start — Arbitrum is making solid progress, drawing a line between itself and profit-seeking speculators. The project’s self-restraint from rushing to issue tokens for quick cash has exactly boosted its growth. By dedicating itself to technology and ecosystem building, Arbitrum has expanded its influence.

According to the latest official plans, Offchain labs will continue to upgrade the Arbitrum protocol. The team will go from Arbitrum One to Arbitrum Nitro and then launch Anytrust Chains to venture into the NFT market and GameFi. Arbitrum is not just a Layer 2 pioneer. In the future, it may even extend Rollup to other Layer 1 projects, opening up a vast growth space for public chain