Last month, reports surfaced on crypto mining research conducted by tech conglomerate Cisco with the following headline: “College kids are using campus electricity to mine crypto.”

Indeed, many students don’t have to worry about paying power bills, as per their university housing contracts, which tend to cover electricity expenses. That “free” power allows them to host cost-efficient mining rigs, where the only expense is the actual hardware. It almost seems too good to be true: Mining students receive a passive income, which can potentially cover the purchase of a few textbooks — or even pay for the whole semester and more.

However, there’s a catch: No electricity is actually free, and someone ultimately has to pay the price.

How popular is mining among students?

Cisco’s security researchers investigated cryptocurrency mining activity across various industry verticals. The research was carried out with the company’s cloud security platform Umbrella, which monitors clients’ network connections to screen malicious activity, allegedly revealing incidents of crypto mining.

According to the findings, university campuses are the second-biggest miners of virtual currency across industry verticals at 22 percent, second only to the energy and utilities sector, with about 34 percent.

As Cointelegraph reported, miner revenues began to wane in 2018 (the last full year for statistics), thanks to the crypto winter and its attendant price drop. That made mining less profitable. But hash rates have continued to increase, indicating that the global mining pool continues to grow, even as individual miners come and go.

Cisco threat researcher Austin McBride explained the trend to PCMag, saying that "you leave [the mining rig] running in your dorm room for four years, you walk out of college with a big chunk of change."

While running mining rigs in dorm rooms, students purportedly avoid electricity costs associated with cryptocurrency mining profitability, said McBride, adding:

"Mining difficulty for a lot of coins is very high right now — which means it costs more for electricity and internet than the profit you can produce from mining those coins. If you don't have to pay for those costs, then you are in a really good spot for making money on the university's dime."

Cointelegraph reached out to Cisco and Cisco Umbrella to clarify which campuses were monitored, but has yet to receive a response.

A similar report was conducted earlier in March 2018, when cyber attack monitoring firm Vectra found out that both intentional cryptocurrency mining and cryptojacking was becoming more prevalent on college campuses than in any other industry.

As per Vectra, universities are not able to monitor their networks as closely as large corporations with high-budget IT departments, “at best [advising] students on how to protect themselves and the university by installing operating system patches and creating awareness of phishing emails, suspicious websites and web ads.”

Students who take advantage of this “free power,” in turn, are “simply being opportunistic as the value of cryptocurrencies surged over the past year,” Vectra’s blog post stated. Matt Walmsley, Europe, Middle East and Africa director at Vectra, told Cointelegraph that, while the scope of their research was international, he cannot disclose which universities participated in the study:

“The data was provided by from education establishments around the world on the understanding that any identifying information would remain anonymous.”

Therefore, while it is difficult to pinpoint the hot spots for college virtual currency mining on the map, the phenomenon seems to be quite popular overall. According to the 2019 Vectra report issued earlier this year, “cryptocurrency mining has surged in popularity with students and criminals, particularly among universities with large student populations.”

Is it really that simple?

One of the main things about mining in university housing conditions is that it has to be discreet — otherwise, the wardens might hear the noise and start investigating. Mark D’Aria, founder and CEO of Bitpro, a New York-based installation and mining operation management firm, told Cointelegraph:

“I suspect the vast majority of mining from college campuses isn't from what you would think of as mining ‘rigs’ — those giant machines with multiple GPUs [graphics processing units], purpose built for mining. ASICs [application-specific integrated circuits] are also certainly going to be extremely rare simply because they're so loud and hot that no one is going to tolerate them in their dorm room for very long. The student is going to need to explain that, and he's not going to get away with it for long.”

Instead, most of the mining seems to be coming from students' old-fashioned PCs, the Bitpro CEO suggested. Notably, casual machines could provide their owners with a moderate income even during the current, bearish market. Given that additional electricity-related expenses are covered by a third-party, of course. According to D’Aria:

“A gaming rig with a single high end GPU could produce maybe $1/day. But even a run of the mill laptop could produce a few cents as well. The important thing to recognize is that even though $1/day is small — if you don't have to pay for electricity, there's no reason for someone with a gaming rig or reasonably powerful laptop *not* to mine. It's literally free money.”

Moreover, generating cryptocurrency with a computer does not necessarily require substantial technical skills and knowledge. “It's extremely easy to do with services such as NiceHash [a crypto cloud mining marketplace], which can be set to automatically mine when you're not using your PC like a screen saver,” D’Aria added.

Indeed, Tom (a pseudonym to maintain confidentiality), a University of Mississippi pharmaceutical sciences student, told Cointelegraph that he used NiceHash with his gaming PC to mine Bitcoin for about two months, but soon decided to abandon the idea because of the continuously high workload and rising GPU prices:

“I was able to make about $120 USD if the price of bitcoin had stayed at $15,000. With bitcoin currently around $4,000 USD it may be profitable, considering I was getting free electricity. However, because of the strain on the system, plus the overinflated prices of GPUs, I wouldn’t do it anymore.”

Tom specified that, being a resident advisor in the dormitory, he was able to make inroads with the local maintenance assistant. That allowed him to make sure that his floor had sufficient air conditioning to host a miner:

“It would be impossible to tell if I had my PC on all the time, especially since it was a huge, 11- story building.”

Tom’s room felt chilly during the winter months, so additional heat was actually useful. He said, “I just used my computer instead of a space heater.”

However, sometimes, mining students get exposed. Ken (a pseudonym to maintain confidentiality), an Arizona State University undergraduate who studies applied physics, showed Cointelegraph a screenshot of an alleged email from a university staff member. In it, Ken was being informed that the security team “has detected a coin miner program” on two of his devices.

“We would like you to either uninstall the programs, or run a virus scan in the event that you were unaware of these programs, as this is indicative of malware on your devices,” it stated.

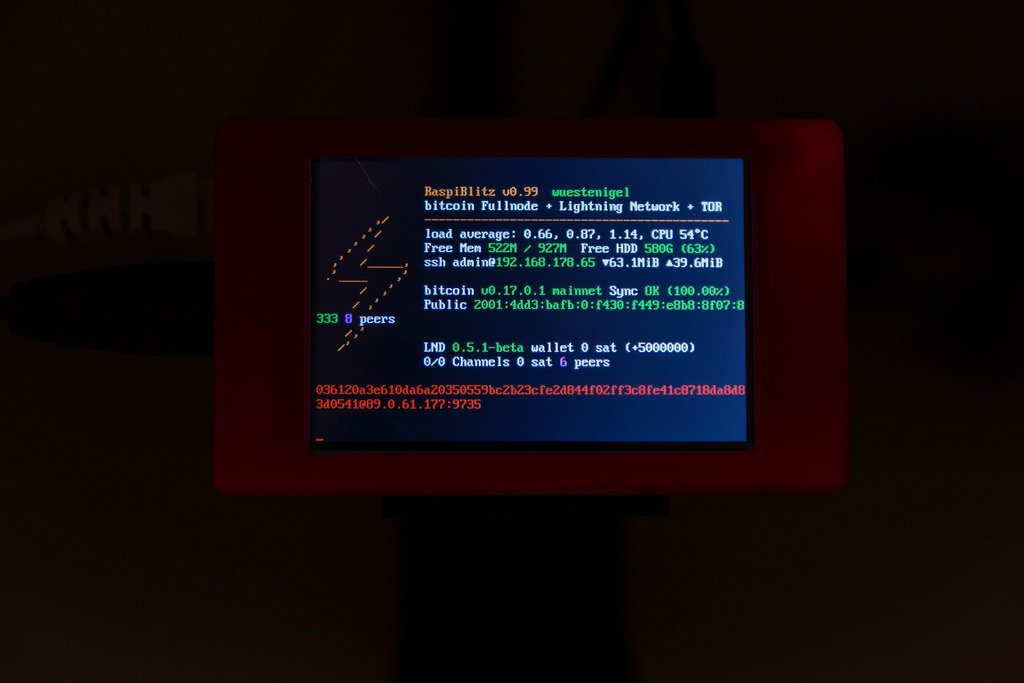

Ken indeed was using NiceHash at the time, as he confirmed to Cointelegraph. After consulting with fellow miners on the r/BitcoinMining subreddit, he decided to use a virtual private network (VPN) whenever he was mining, saying: “I already had one, and I made sure that it turned on startup and the internet kill switch was active so they couldn’t track me.”

However, once Ken had managed to mine “a couple of hundred dollars,” NiceHash was hacked, and the student lost a large percentage of his funds, as he hadn’t yet moved them to a private wallet.

Chris Partridge is a computing security graduate from the Rochester Institute of Technology (RIT), who also mined cryptocurrency during his time in college, starting in 2015 and continuing until mid-2016. “I was curious about Bitcoin and that seemed like a good way to learn,” he told Cointelegraph. His setup was a bit more advanced compared with Tom and Ken, as he used “a couple” of Antminers, a BFL Monarch and a Prospero X1. Consequently, the amount of heat produced by his equipment was significantly higher:

“None of them [the mining rigs] were remotely current-gen even at the time, and all of them were heavily underclocked/undervolted/modded to be cooler and quieter. Living up in Rochester [New York), where it was freezing all the time, we had our window open 24/7 (even during blizzards!) and the miners pointed out into it, or else it became too hot in our living areas very quickly. It was a bit of a strain for my roommate and I, but he was a good sport about things.”

Partridge said that he was never caught in the act, despite a couple of room checks that occurred due to unrelated reasons. “Nobody seemed to care,” he said. “Especially since it was a very small operation — I suppose I came off as a bit eccentric, but no further investigation was prompted.”

Even though it wasn’t a profit-focused endeavor for the former RIT student, he walked away with around 0.4 BTC, which he then sold for a hefty sum of $6,000. The earnings came at just the right time: Partridge needed cash that would carry him through to an internship. After spending the money on general living expenses for a few months, he even had some left over for nonessential shopping:

“I also bought a Roomba, because if there's anything I'm going to spend profits from magic internet money on, it's a Roomba.”

There are even larger success stories: Marco Streng, co-founder and CEO of Genesis Mining, a large cloud mining company whose farms are located across several countries, claims that he essentially started his business out of a dorm room back in 2013. He declined to specify which university he went to, however, saying that it’s “the same anywhere in the world.”

“There was this kind of sauna atmosphere in my 10-13 square meter room, and the noise was really loud,” he told Cointelegraph. “We tried to mitigate it by putting some pillows over the miner and put it closer to the window to cool it down.”

Streng said that, while the uproar was attracting attention, his neighbors didn’t seem disturbed. “I mean, I found it annoying, but it was a trade-off for me,” he added. “I was excited, passionate, and there was an economical aspect — it created some money.”

Around 2014, Streng realized that the local student community had started to actively set up their own mining rigs across campus. “The rumour was spreading, so it [mining] got some traction,” he recalled. “The electricity bill of the student dorm went up quite significantly.”

When crypto market began growing and Streng’s activity became increasingly profitable, he realized that he could run “a few thousand of those machines,” establishing a mining operation on an industrial scale.

“That lead to the creation of Genesis Mining, one of the largest mining companies,” Streng told Cointelegraph. “I’m really happy that I did that in my dorm and found that opportunity. Otherwise, it would never have come this far.”

How legal and ethical is that?

While no university seems to have a specific policy in regard to cryptocurrency mining on its premises, in January of 2018, Stanford University issued a public warning against crypto mining on campus, arguing that school resources “must not be used for personal financial gain.” The warning also cited the university’s chief information security officer:

“Cryptocurrency mining is most lucrative when computing costs are minimized, which unfortunately has led to compromised systems, misused university computing equipment, and personally owned mining devices using campus power.”

Indeed, many universities seem to prohibit the use of their resources for personal financial gain — including the ones observed in this article. RIT’s code of conduct for computer use, for instance, states the following:

“No member of the RIT community may use an RIT computing account or any communications equipment that is owned or maintained by RIT to run a business or commercial service or to advertise for a commercial organization or endeavor. [...] Consistent with other specific policies, members of the RIT community should not waste university resources or use them for personal benefit or for the benefit of a non-university entity.”

However, not having specific rulesets for cryptocurrency mining might actually induce tax problems for educational institutions who (unwillingly or not) host such activity on their premises. As Selva Ozelli, international tax attorney and CPA, told Cointelegraph:

“Given that electricity is usually included in a student's tuition or rent, Universities would need to set policy as to whether they will allow cryptocurrency mining on campus premises or not or whether students should be charged extra for electrical expenses relating to cryptocurrency mining. If Universities do not set proper policy in this regard, they could subject themselves to tax problems. Because section 4, Q&A-8 of Notice 2014-21 states that cryptocurrency mining which is treated as a service activity should be treated as ordinary income in the year it is mined, and the expenses of mining — including electrical charges — deducted as incurred based on the matching of income and expenses."

From an ethical point of view, the situation is also quite complex, and opinions vary even among those who benefited from mining on campus.

“I pay to have the room and since no explicit details in my contract punished overuse of electricity I figured I was fine, especially since I would have had to use a space heater anyway because students couldn’t control the temperatures in their own rooms,” said Tom from the University of Mississippi, denying that he was in the wrong for setting up a mining rig in his room.

Rochester Institute of Technology’s Partridge was more critical. “I don't believe it's ethical to mine at scale on college campuses,” he told Cointelegraph. “The electricity being ‘free’ to me isn't the same as the electricity being free, unfortunately.” The former RIT student recalled that he burned around $200 while mining in his dormarty, “assuming they get pretty solid commercial electrical rates.” He continued:

“Most people who claim that mining on campuses is ethical don't take into account an important second variable: this is not without risk. Student housing isn't designed to accommodate large quantities of electronic equipment, and couldn't suppress or otherwise contain electrical fires - that could easily lead to massive property damage and loss of life.”

Streng, the Genesis Mining CEO, believes that, while students can contribute to the decentralized network via mining, they shouldn’t exploit the resources of their universities and inform the local administration, if possible. “I think it’s great if a student wants to do it [mine in his/her room] and is excited about it,” he said. “But of course they have to pay their bills.” He continued:

“The new side-effect of the whole cryptocurrency idea is that someone living in a small room can turn electricity to money. There are many institutional setups — not only in education — when someone is paying for the electricity of a specific area, while residents have to pay a flat contribution no matter how much electricity they consume. I think those providers should be aware of these possibilities now and that people can make use of them. They should respect that and draft it into their agreements.”

Therefore, if universities continue to largely overlook mining on their premises, the phenomenon is likely to stay, allowing students to at least earn some beer money.

“I can't imagine any college student is going to turn down $30/month or even $5/month,” said D’Aria of Bitpro. “Even though they're dealing with small amounts on an individual basis, dorm room mining is introducing cryptocurrencies to a whole generation of young adults. It doesn't take them long to figure out how easy and useful it is to use something like Ethereum to split the cost of a 12 pack of natty ice — particularly when there's no credit card statement their parents can keep an eye on.”

Source